Gas fees are an integral part of blockchain ecosystems, ensuring that networks function smoothly and securely. For crypto enthusiasts and traders, understanding gas fees is essential—especially for those participating in airdrops and DeFi projects. This article dives deep into what gas fees are, their significance, how they vary across blockchains, and the best platforms to track them.

Note: This is the first comprehensive article on “Gas Fees Explained” generated exclusively for your crypto airdrop blog.

What Are Gas Fees?

Gas fees are payments made by users to compensate miners or validators for the computational energy required to process and validate transactions on a blockchain. Think of it as a transaction fee, but specific to decentralized systems.

Why Are Gas Fees Necessary?

- Network Security: Gas fees incentivize miners or validators to maintain the blockchain’s security and integrity.

- Prevent Spam: Charging gas fees discourages spamming and malicious activity by making transactions costlier.

- Fair Resource Allocation: Higher fees can prioritize urgent transactions, ensuring smooth operations during high network congestion.

How Are Gas Fees Calculated?

The calculation of gas fees involves several components, varying by blockchain. Here’s how it works:

1. Gas Limit

- The maximum amount of computational work required to process a transaction.

- For example, sending ETH might have a gas limit of 21,000 units, while executing a complex smart contract could require significantly more.

2. Gas Price

- The amount you’re willing to pay per unit of gas, usually measured in Gwei (1 Gwei = 0.000000001 ETH).

- Higher gas prices incentivize miners to prioritize your transaction.

3. Base Fee (Specific to Ethereum post-EIP-1559)

- A minimum fee required for inclusion in a block, dynamically adjusted based on network demand.

4. Priority Fee (Tip)

- An optional additional payment to miners to prioritize your transaction over others.

Formula:

Total Gas Fee = Gas Limit x (Base Fee + Priority Fee)

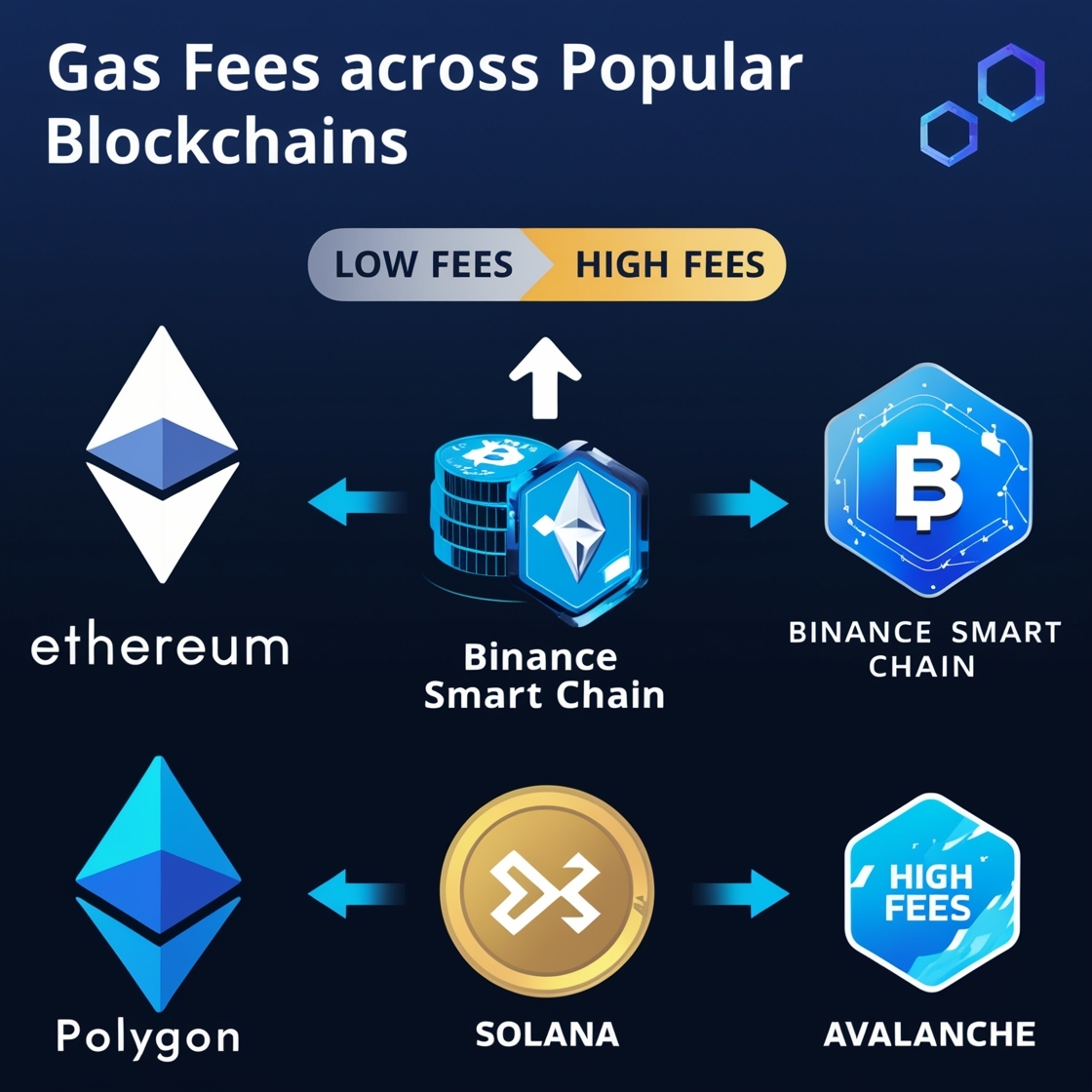

Gas Fees Across Popular Blockchains

Different blockchains have unique mechanisms and costs associated with gas fees. Let’s compare:

| Blockchain | Gas Fee Model | Typical Cost | Popular For |

|---|---|---|---|

| Ethereum (ETH) | Gas Units x Gas Price (in Gwei); EIP-1559 introduced a base fee and tip system | $1 to $50+ | DeFi, NFTs, and complex smart contracts |

| Binance Smart Chain (BSC) | Fixed at 5 Gwei | $0.01 to $0.10 | Low-cost DeFi and airdrops |

| Polygon (MATIC) | Extremely low fees due to Layer 2 scaling solutions | < $0.01 | Gaming, NFTs, and airdrops |

| Solana (SOL) | Optimized for scalability; very low fees | $0.00025 | High-speed DeFi and gaming |

| Avalanche (AVAX) | Dynamic pricing model | $0.10 to $0.70 | High-performance applications |

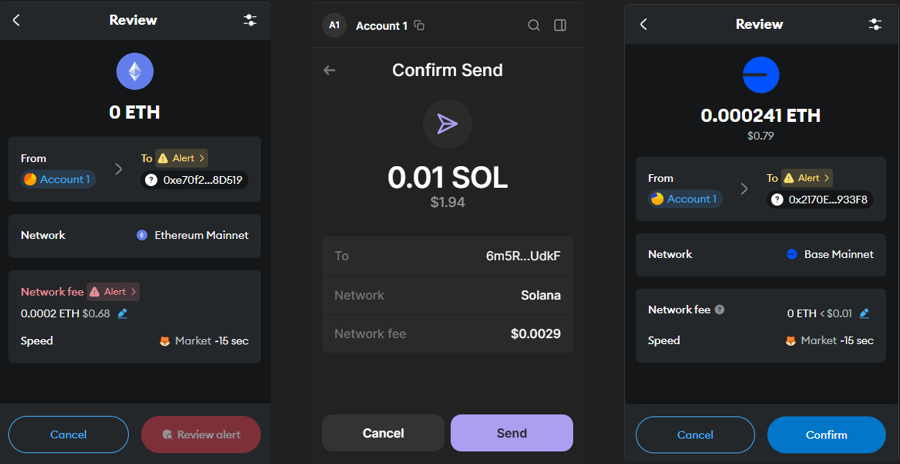

Wallets and Extra Fees

While gas fees are charged by the blockchain network, certain crypto wallets and platforms may add additional fees for processing transactions. These fees are often used to cover operational costs or as a revenue model. Here’s how some popular wallets handle fees:

| Wallet | Additional Fees | Use Case | Notes |

| Trust Wallet | Small additional network fee | Multi-chain support; DeFi integration | Transparent fee structure |

| MetaMask | Service fee of ~0.875% | Ethereum-based transactions; DeFi | Includes optional gas fee adjustment |

| Bitget Wallet | Low transaction fees | Trading-focused; supports multiple chains | Often lower fees than competitors |

| Ledger Live | Depends on blockchain | Hardware wallet transactions | Prioritizes security over cost |

| Exodus Wallet | Varies; typically higher fees | User-friendly multi-asset wallet | May include convenience fee |

| Coinbase Wallet | Additional fees for swaps | Seamless exchange and DeFi access | Fee structure depends on service used |

| SafePal Wallet | Slight markup on fees | Supports hardware and software wallets | Transparent and multi-chain compatible |

Why Do Wallets Charge Extra Fees?

- Operational Costs: Wallet providers incur expenses related to infrastructure and development.

- Revenue Model: Some wallets include a small markup to generate revenue.

- Convenience: Fees may cover additional services such as faster transactions or improved usability.

How to Compare Gas Fees?

Given the differences in gas fee structures, having tools to monitor and compare them is invaluable. Here are some reliable platforms:

1. Etherscan (Ethereum)

- Features: Real-time gas tracker, historical gas trends.

- Website: etherscan.io/gastracker

2. BscScan (Binance Smart Chain)

- Features: Gas cost estimation for smart contracts.

- Website: bscscan.com/gastracker

3. Polygon Gas Tracker

- Features: Tracks MATIC gas prices.

- Website: polygonscan.com/gastracker

4. Solana Beach (Solana)

- Features: Visualizes Solana network stats, including gas fees.

- Website: solanabeach.io

5. Avalanche Explorer

- Features: Tracks transaction fees on the Avalanche network.

- Website: avascan.info

6. CryptoFee.info

- Features: Compares average transaction fees across major blockchains.

- Website: cryptofees.info

Tips to Minimize Gas Fees

- Optimize Transaction Timing:

- Gas fees fluctuate based on network demand. Use gas trackers to identify low-demand periods.

- Batch Transactions:

- Combine multiple transactions into one to save on cumulative fees.

- Choose Low-Fee Networks:

- For airdrops and small-value transactions, opt for networks like Polygon or Solana.

- Leverage Layer 2 Solutions:

- Networks like Arbitrum and Optimism reduce Ethereum gas fees significantly.

- Adjust Gas Settings:

- If a transaction isn’t urgent, set a lower gas price in your wallet.

Conclusion

Gas fees are an unavoidable aspect of interacting with blockchain networks, but they serve a critical purpose. By understanding how they work and leveraging tools to monitor them, you can save money and optimize your crypto transactions. For crypto airdrop hunters, being aware of gas fees and the networks with the lowest costs can significantly enhance your experience.

Stay informed and always compare gas fees to make the most of your blockchain interactions. For more insights on crypto airdrops and blockchain tips, explore our other guides!