Introduction: What is Crypto FOMO?

Imagine you hear a friend saying, “Bitcoin is skyrocketing! If you don’t buy now, you’ll miss out!” Your heart races, and before you know it, you buy at the peak price—only to see it crash the next day. This feeling is called Crypto FOMO (Fear of Missing Out).

FOMO happens when investors rush into a crypto trend due to hype and emotions rather than logic. It often leads to buying high and selling low—exactly the opposite of smart investing. In this guide, we’ll explore how to control FOMO and avoid costly mistakes.

Why Does Crypto FOMO Happen?

Crypto FOMO isn’t just about greed—it’s psychology. Here’s why people fall into the trap:

- Fear of Missing Out on Profits – Seeing others make money makes you want to jump in.

- Hype from Social Media & News – Tweets, YouTube videos, and news make it seem like “everyone is getting rich.”

- Explosive Price Movements – When a coin rises 100% in a day, it creates urgency.

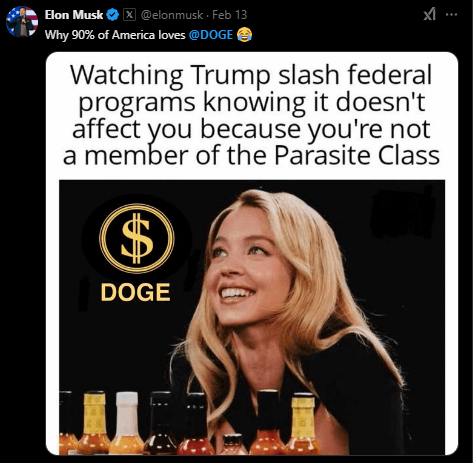

- Influencer & Celebrity Endorsements – Big names hyping a coin make it feel “safe” when it’s often not.

- Peer Pressure – Friends telling you “It’s now or never!” can make you ignore logic.

Real-Life Example of Crypto FOMO Gone Wrong

The 2021 Dogecoin FOMO: In early 2021, Dogecoin was trading at under $0.01. After tweets from Elon Musk, its price soared. Many new investors bought in at $0.70, thinking it would hit $1 soon. But after the hype faded, Dogecoin crashed below $0.20, leaving FOMO buyers with heavy losses.

The lesson? If a coin has already surged massively, it’s risky to jump in.

How to Avoid Buying at the Top: Pro Strategies

1. Do Your Own Research (DYOR)

Don’t trust random social media posts. Check:

- Project fundamentals – What problem does the crypto solve?

- Team & Developers – Are they reputable?

- Market Cap & Supply – Is it overvalued?

- Community & Adoption – Does it have real-world use?

2. Ignore Hype, Focus on Strategy

Emotional decisions lead to losses. Use a plan like:

- Dollar-Cost Averaging (DCA) – Invest small amounts over time instead of one big purchase.

- Set Entry & Exit Points – Decide in advance at what price you’ll buy or sell.

- Follow Technical Indicators – Instead of hype, use charts and trends.

3. Wait for Dips Instead of Chasing Green Candles

If a coin has already pumped 100%+ in a short time, it’s better to wait for a pullback. Corrections are normal, and better buying opportunities often come later.

Example:

- Instead of buying Bitcoin at $69,000 during a peak, patient investors bought during a dip at $40,000, gaining better returns.

4. Don’t Follow the Herd

By the time everyone is talking about a coin, the smart money has already taken profits. Instead, look for undervalued projects before they get popular.

5. Use Stop-Loss Orders

A stop-loss order automatically sells your crypto if the price drops below a set level. This prevents big losses if a coin crashes.

Example:

- You buy Ethereum at $3,000 and set a stop-loss at $2,800. If the price drops, your loss is limited instead of watching it crash to $1,500.

6. Understand Market Cycles

Crypto moves in cycles:

- Bull Market – Prices surge, and FOMO is high.

- Bear Market – Prices drop, and fear takes over.

Knowing where we are in the cycle helps you avoid buying at peaks.

Smart Investor Mindset: How Pros Avoid FOMO

- Patience Pays Off – The best investors wait for good opportunities instead of rushing in.

- Control Your Emotions – Fear and greed lead to bad decisions.

- Think Long-Term – Instead of quick gains, look at crypto as a 3–5 year investment.

- Learn from Past Mistakes – If you’ve fallen for FOMO before, use that experience to be smarter next time.

Advanced Strategies to Stay Ahead in Crypto Investing

1. Diversify Your Investments

Never put all your money in one coin. Diversification reduces risk. Consider:

- Top Cryptos (BTC, ETH, BNB, etc.) – More stable and widely adopted.

- Mid-Cap & Low-Cap Projects – Potential for growth but higher risk.

- Staking & Yield Farming – Earn passive income from crypto holdings.

2. Understand Technical Analysis Basics

While not foolproof, technical analysis can help identify better entry points. Learn about:

- Support & Resistance Levels – Where prices tend to bounce or break.

- RSI (Relative Strength Index) – Indicates if a coin is overbought or oversold.

- Moving Averages – Helps spot trends over time.

3. Keep an Eye on Market Sentiment

Tools like Google Trends, Crypto Fear & Greed Index, and social media analytics help gauge if the market is overheated or fearful. Buying during fear and selling during greed is a smart move.

4. Follow Smart Money Moves

Track large investors (whales) and institutional activity. If smart money is accumulating during a dip, it’s a strong signal.

5. Use Secure Storage & Risk Management

- Store long-term holdings in hardware wallets (Ledger, Trezor, Safepal Hardware wallet) to prevent hacks.

- Avoid leveraged trading unless experienced—it magnifies losses.

- Keep an emergency fund to avoid panic selling during dips.

Conclusion: Take Control of Your Crypto Journey

Crypto FOMO is a powerful emotion, but smart strategies help you stay in control. Avoid chasing hype, do your research, and invest wisely.

Your Next Step:

- Save this guide to remind yourself to stay patient.

- Follow a solid investment plan instead of reacting to emotions.

- Subscribe to trusted crypto news sources instead of hype-driven influencers.

By thinking like a pro, you can avoid buying at the top and make smarter investment decisions. Happy investing!